Goal

Improve Recruta Simples’ sign up conversion. Recruta Simples is a web app where entrepreneurs and recruiters can post jobs on +100 job sites with just 1 click.

Research

7bits worked full time in Recruta Simples for more than 1 year, redesigning most of the web app. For this reason, we made several improvement projects, but it is worth highlighting this project of the sign up flow because we could go through the entire design process (research, prototyping and validation).

To contextualize the importance of the sign up flow to the web app, we need to explain its business model. The platform has a monthly subscription model with a low average ticket and aims to reach the largest number of micro and small businesses in Brazil.

Because of this strategy, the balance between CAC (customer acquisition cost) and LTV (lifetime value) is crucial. In this scenario, the registration flow becomes very important for it impacts directly the CAC.

In short, the simpler the registration flow, the lower the CAC, positively impacting the financial health of the business (metric LTV/CAC).

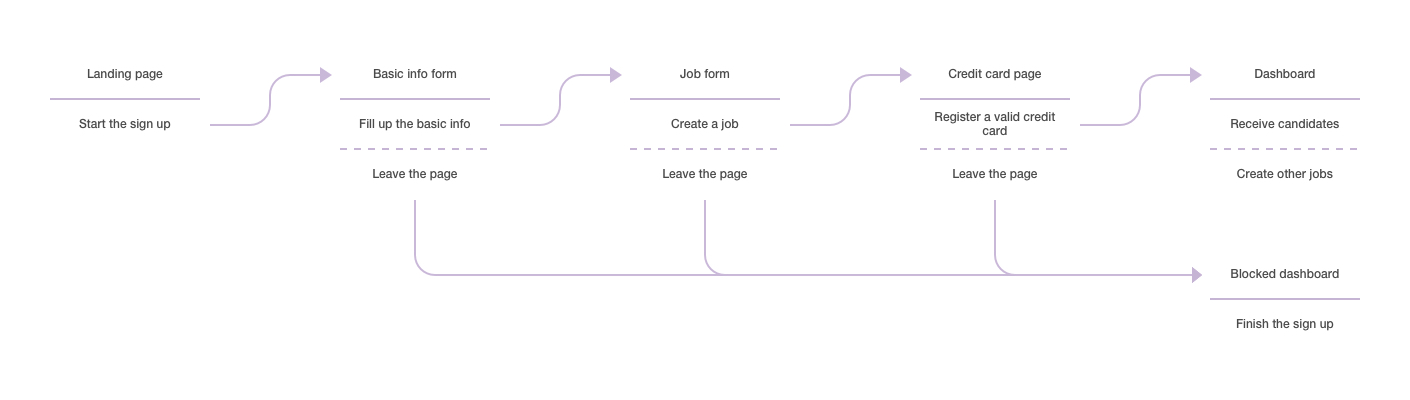

See Recruta Simples’ sign up flow:

User flow: Recruta Simples' sign up

Looking at the metrics for this funnel, we noticed that the biggest break was on the credit card page. This worried us a lot because by registering a card, the client could unlock a 5-day free trial.

Since we didn’t know exactly the reason for this break, we’ve created some questions and started calling all the customers who were dropping off on the credit card page.

The result of this research was a spreadsheet with +30 qualitative answers about the reason for the drop off. Throughout the research, we’ve identified patterns of responses and annotated frequencies.

The main reasons were within these 4 broad categories:

- My company only works with bank slip

- I don’t have the autonomy to use my company’s credit card

- I don’t feel comfortable to put my credit card in websites

- I don’t think it will be simple to cancel the service

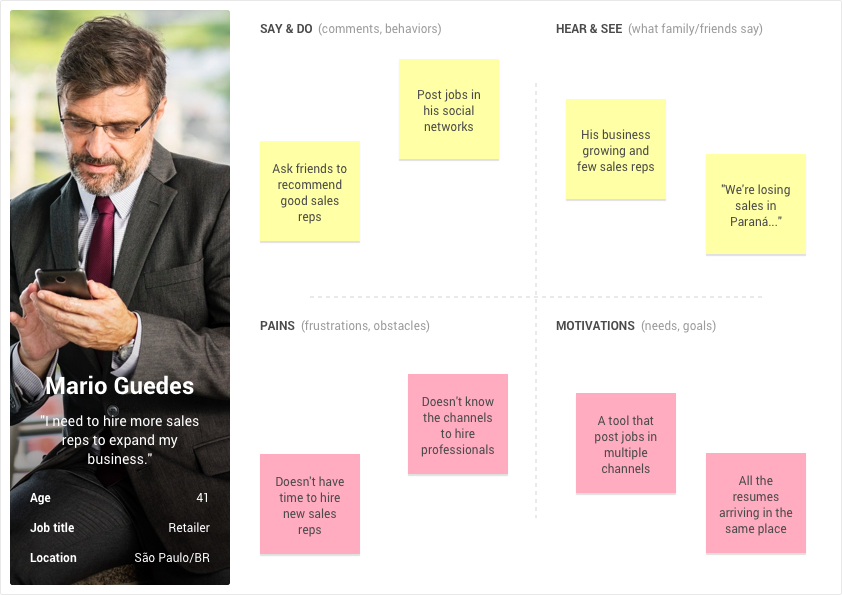

After discovering the reasons, we tried to correlate with our 2 main customer profiles. See below the Empathy Map of Mario, owner of a micro company and Kelly, HR analyst of a small company.

Empathy map: Mario (Entrepreneur)

For customers in Mario's profile, we’ve created the following hypothesis:

"Because he owns a micro business, he would have the autonomy to use the company’s credit card. The main problem for him would be to trust the service and cancellation process."

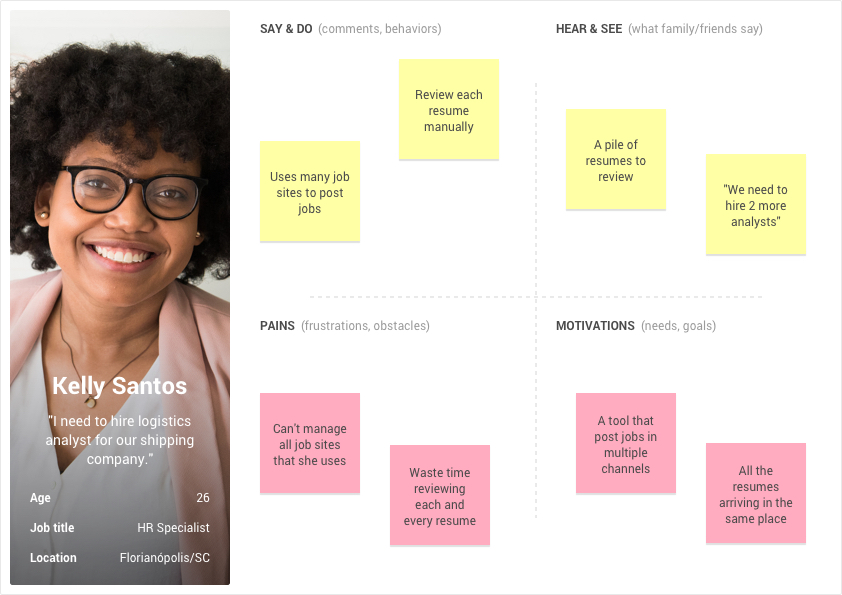

Empathy map: Kelly (HR analyst)

For customers in Kelly's profile, we created the following hypothesis:

"Because she works in a small business, she wouldn’t have the authorization for using the company’s credit card. The main problem for her would be to approve the payment by bank slip or credit card. "

Prototyping

To validate our hypotheses, we set out for a more quantitative research.

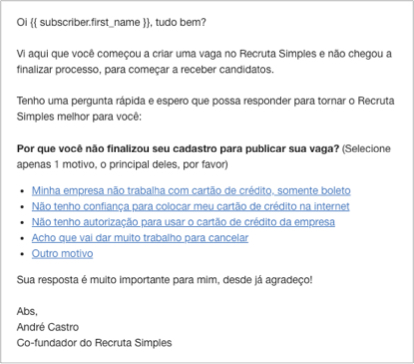

We’ve created an email that would be sent to everyone who dropped off on the credit card page. In this email, we put the question "Why didn’t you finish your registration to post your jobs?" and links for people to click and respond.

Email with the question

The links had 2 categories, which directed people to landing pages with different CTAs (call to action).

The first category was related to trust, so we directed the person to a landing page with the CTA to "request assistance". The second one was related to payment methods, so we directed the person to the landing page with CTA to "request a quote".

See the landing pages:

Landing page: Recruta Simples

Note that the two landing pages have sections like:

- Frequently asked questions

- News about Recruta Simples

- Logos of the main customers

- Testimonials

All these points serve as social proofs and were placed on the landing pages to bring more confidence at this payment moment.

In less than 1 week the email and the landing page variations were up and running. The sales and support teams were notified and trained to deal with the 2 different demands:

- CTA to "request assistance": Answer questions via chat or even call to pass more credibility/trust.

- CTA to "request quote": Call to better understand the demand and already generate the bank slip according to the chosen plan.

Validation

When we stopped to analyze the results, we crossed 3 information:

- Our two personas

- Our segmentation metrics (by company size and by position)

- The answers to "Why didn’t you finish your registration to post your jobs?"

The hypotheses about Mario’s behaviors were confirmed, registering a credit card was not a problem.

On the other hand, we realized Kelly's scenario was not that simple. The only certainty we had was that the combination of "HR professional" with company size "greater than 100 employees" resulted in a lower conversion.

After this experiment, we decided to change our sign up flow to try to convert more customers like Kelly. Basically, when we identified this profile during the sign up, we would direct the person to a different flow.

In this flow, customers could test the tool without registering a credit card. And after the free 5-day trial, they could choose between paying by bank slip or credit card.

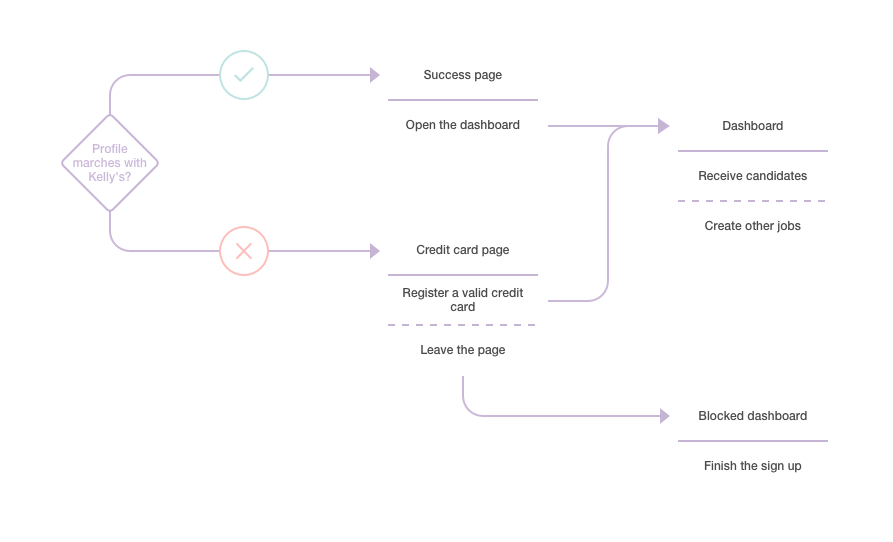

Here's the sign up flow 2.0:

User flow: Recruta Simples' Sign up 2.0

With this sign up 2.0, all customers in Kelly's profile began testing the tool. It was positive for the business because this customer profile usually posts more jobs and is more likely to buy larger plans (having a higher LTV).

In an upcoming article, we'll explain how we’ve used the learnings from this experiment to improve the sign up flow even more. In this 3.0 version, we’ve includes a self service option for the customers to generate their bank slip.